Is Buy Now Pay Later Growing in Adoption?

In an age where consumers have been conditioned to expect instant gratification, perhaps it’s no surprise that the Buy Now Pay Later (BNPL) shopping model has become the newest trend to sweep online and in person retailers, as well as the Fintech Industry overall.

Not just your father’s old school layaway, the Buy Now Pay Later method is preferable, offering customers their items immediately with an interest-free payment plan and often without deposit, service, or cancellation fees. Furthermore, BNPL is available at many higher end retailers that don’t offer layaway.

Keen to learn more about current and future adoption of this payment trend, we consulted more than 1,000 members to obtain valuable consumer insights about their BNPL practices.

While Gen Z and Millennials are more likely to have used BNPL previously (40-45%) than Gen X (33%) and especially, Boomers (21%).

In addition to the 91% of BNPL users that agree that these services come in handy for unexpected/last minute purchases, some of the other motivators to use BNPL are that these services “enable me to make more purchases” (77%) and/or “make it easier to stick to a budget” (69%).

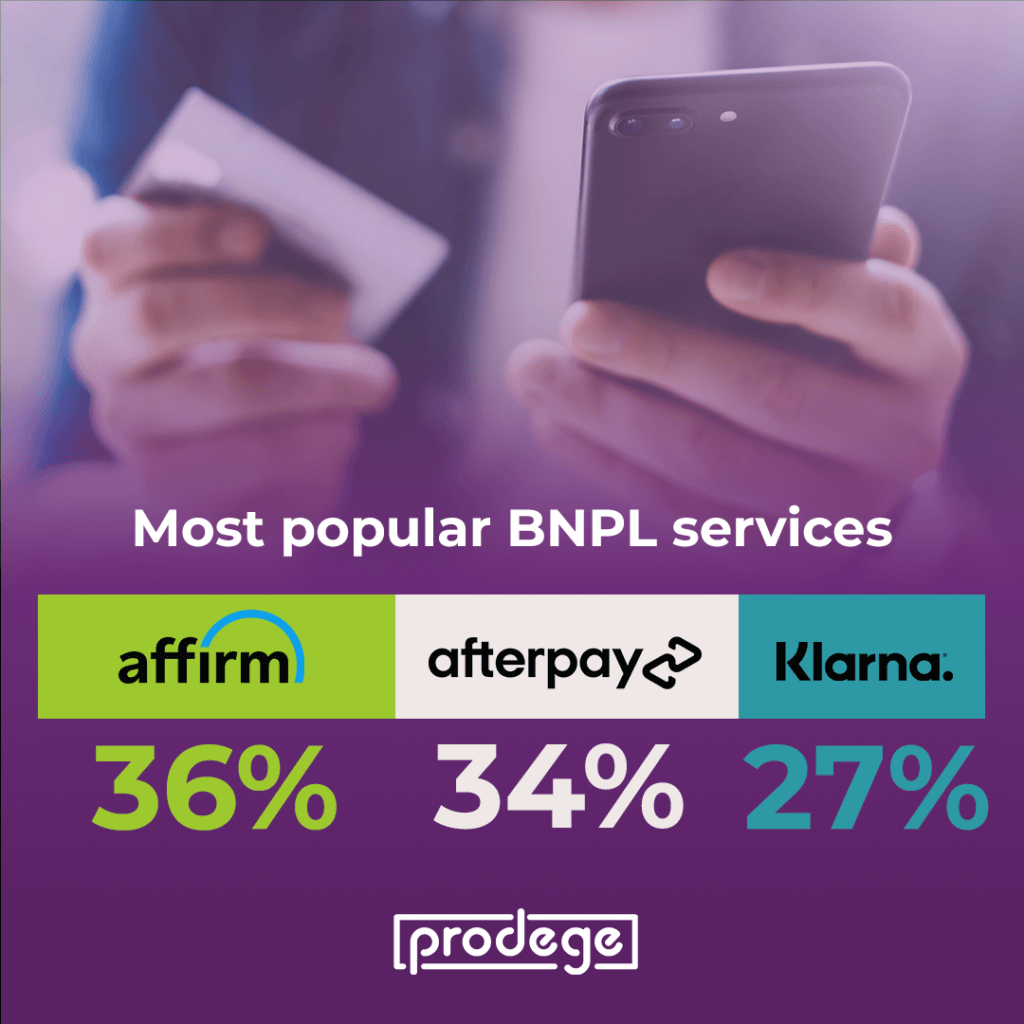

So what exactly are they buying? Electronics/gadgets, clothing, and appliances are the top product categories the consumers we surveyed have used BNPL for.

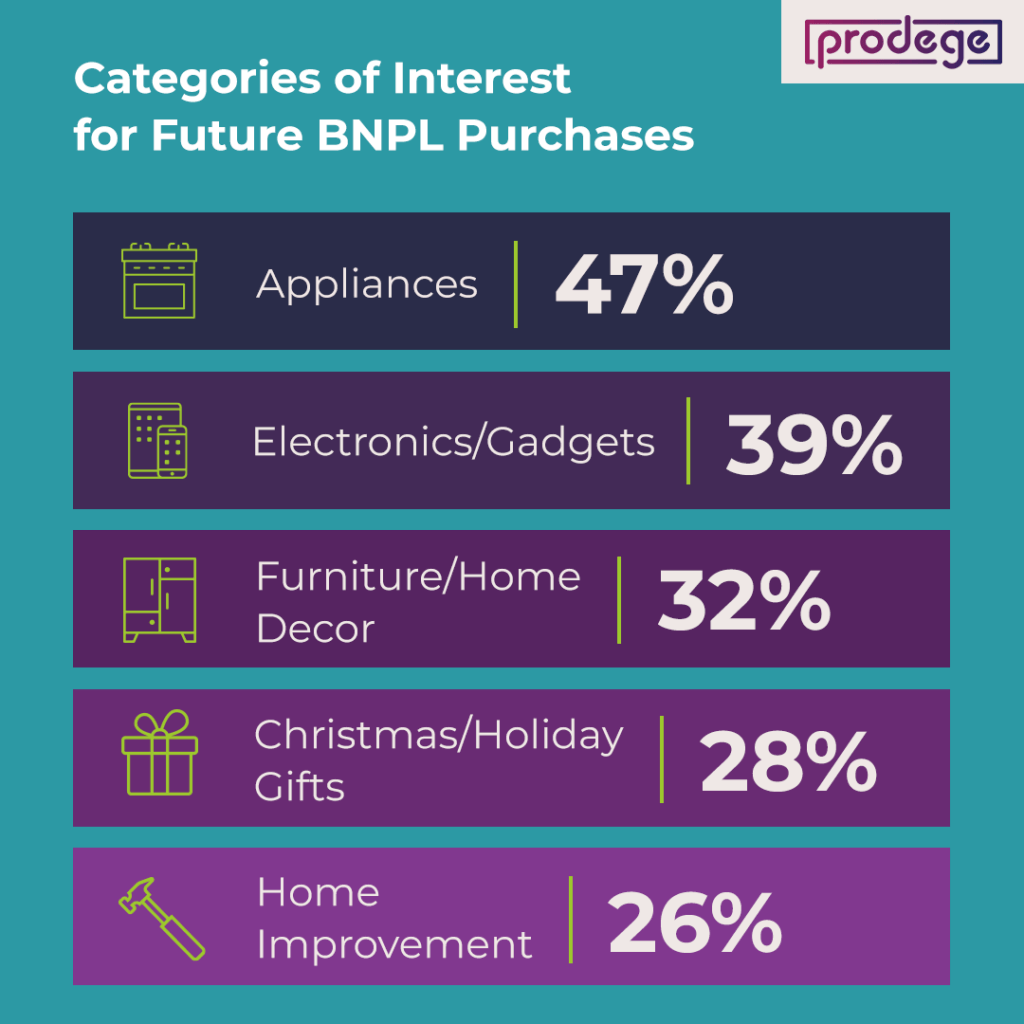

Looking ahead, 38% of the members we surveyed overall are “very” or “somewhat” likely to use BNPL in the next six months; when looking only at past BNPL users, this figure rises to 70%! Another 37% say they may use BNPL if they have the need to make a big purchase. The main product categories consumers would consider using BNPL in the next six months for are:

Of those who haven’t used BNPL services before, 21% have considered using it in the past and another 22% weren’t very familiar with it but are curious to learn more. With the holiday shopping season upon us, it’s likely this may be the time they decide to give it a try!

Looking to reach an engaged audience of consumers who are open to trying new products, brands, or payment methods? Reach out with more information and we’ll determine the best solution for you!

Rachel Kaye

Share This Article

Recent Press Releases

Upromise Extends a Helping Hand to Student Loan BorrowersWith 68% of borrowers making financial sacrifices to repay their student loans, Upromise now offers [...]

71% of Self-identified Snorers Have Never Consulted a Healthcare ProfessionalNational survey identifies major obstacles to treating snoring and sleep issues June 28, 2023 08 [...]

Prodege’s 2023 Summer Survey: 55% of Americans Plan to Travel This Summer45% will travel more than last summer. 73% plan to drive with 36% planning to fly to their summ [...]